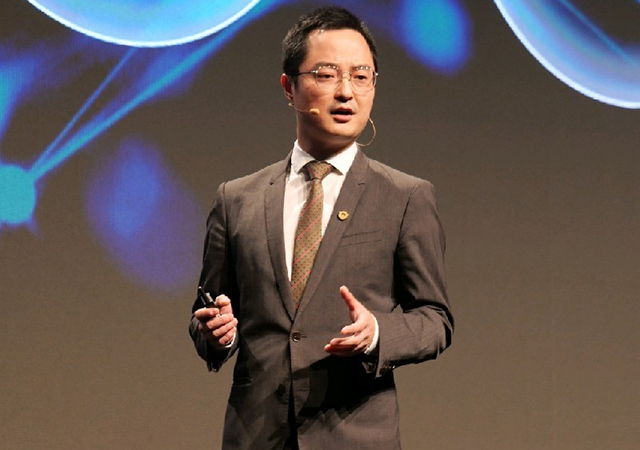

Khamis Juma Buamim, board member, managing director<br>and group CEO of Gulf Navigation Holding

Khamis Juma Buamim, board member, managing director<br>and group CEO of Gulf Navigation Holding

Dubai-based Gulf Navigation Holding has announced refinancing 'Gulf Mishref' and 'Gulf Mirdif' petrochemical carriers, less than a month after increasing its capital to Dh1 billion ($272.25 million) through an initial public offering (IPO).

The move underlines the increasing demand for the company’s shipping services, which requires increasing its fleet capacity to meet the demand for its services in the region, said a statement.

Refinancing the two carriers is an important addition to the company's petrochemical transportation capabilities, it said.

This has reflected positively on the value of the company's assets, which jumped from Dh958,956 ($261,075) to Dh1.08 million ($294,560), with an increase of 13 per cent equal to Dh123 million ($33.48 million), it added.

Khamis Juma Buamim, board member, managing director and group CEO of Gulf Navigation Holding, said: “Our ability to refinance the two carriers under the current global financial, economic, and shipping conditions is a testament to the significant transformation in the Group and the confidence of financiers and stakeholders in the company.”

“We have promised our investors and shareholders to increase the value of our assets and the number of vessels in our fleet to make the company one of the key marine service providers in the region,” he said.

“This will help us meet the growing demand in the liquidation and oil derivatives markets, which will further expand over the next 10 years. Acquiring this kind of tankers will give us a very competitive value and make us a preferred option for strategic customers to discuss and sign long-term contracts,” he added.

Buamim continued: “This will increase our profits because managing and operating our own vessels will yield far higher returns than chartered vessels, supporting a sustainable financial and operating performance for us and help us make more profits.”

“Each of the vessels have the capacity to carry over 26,000 tonnes of chemical cargo and each of them has 29 separate tanks. The two carriers can therefore meet demands for long-haul transportation of petrochemicals and miscellaneous petroleum products,” he said.

“The two vessels operate on the East Coast of the US and the Gulf of Mexico and further trips between the West African coast and Europe. This increases the range of the markets that our specialised shipping services can reach,” Buamim concluded.

The company will continue to increase its assets and expand its fleet to reach to 20 vessels by 2020, said a statement.

Raising the capital through the company's IPO of Dh1 billion ($272.25 million) provides continuous liquidity to enhance the company's ability to expand. When it completes its fleet and operational equipment expansion plan, the company will become one of the largest comprehensive stops in all areas of marine services, and will be able to achieve its strategy and goals by 2021, it stated. – TradeArabia News Service