The country has been investing heavily in boosting its local manufacturing capabilities

The country has been investing heavily in boosting its local manufacturing capabilities

The UAE appears to be making impressive inroads to redefine regional pharmaceutical market considering the country’s market has grown above the global average at 7.5 per cent since 2016 and is projected to grow by 27 per cent between 2021 and 2025, according to a report released by Abu Dhabi holding company ADQ.

The size of the local pharmaceutical market is expected to reach $4.7 billion in value by 2025, up from $3.7 billion in 2021 and $1.5 billion in 2011, predicted the ADQ FWD white paper titled Redefining Regional Pharma.

According to Jaap Kalkman, group chief investment officer at ADQ, the paper was launched to “examine key opportunities and investments for enhancing regional pharmaceutical capacity to ensure access to affordable, quality medication while advancing innovative treatments.

With a track record of substantial infrastructure investments, unprecedented legal reforms, and robust regulations, the UAE has become a regional hub for the pharmaceutical industry over the past decade and created an environment conducive to sustainable growth.

According to the UAE Ministry of Health and Prevention (Mohap), there are more than 6,100 generic medicines and products available in the UAE. Steps have already been taken to spearhead a transformation in pharmaceutical manufacturing, underpinned by a strategic collaboration between the private sector and public institutions.

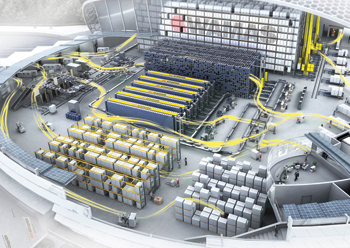

The number of manufacturing units in the UAE has expanded rapidly from 4 in 2010 to 23 in 2021, with 14 producing medicines, seven manufacturing medical devices and two generating disinfectant solutions. With this, there are now more than 2,500 medicines produced in the UAE.

The UAE’s plans to localise the pharmaceutical industry were set in motion over a decade ago, with the sector identified as instrumental for the nation’s diversification plans.

Today, the UAE, which exports its pharmaceutical products to 48 countries, plans to grow its pharmaceutical export market to about $297 million by 2025, up 15 per cent from 2021. The GCC nation’s export market stood at $251 million in 2020, the report stated. The country, which still imports about 80 per cent of its pharmaceutical products, has been investing heavily in boosting its local manufacturing capabilities to reduce costs and ensure steady supplies. The country expects to import pharma products worth $3.8 billion between 2021 and 2025.

Last year, the Emirates became the first country regionally to set up a coronavirus vaccine factory after a phase three clinical trial of the inactivated Covid-19 vaccine. The joint venture between Sinopharm and G42 Healthcare aims to produce up to 200 million Hayat-Vax doses annually at a factory in the Kizad Life Sciences Park.

In December, Abu Dhabi’s Mubadala Investment Company also joined forces with Group 42 to set up a biopharmaceutical manufacturing campus in the UAE capital.

The campus will tap into global vaccine and therapeutic products to strengthen regional supply chains and drive the country’s diversification and economic growth agenda, the organisations said.

Currently, 11 pharma multinationals including Johnson & Johnson, AstraZeneca, Novartis, Roche, Pfizer, GSK and Sanofi, operate in the UAE.

“From building public-private partnerships, incentivising pharmaceutical companies and opening up market access for innovative and novel medicines, we are realising the UAE’s vision to be a leading pharmaceutical hub for the region and beyond,” Dr Amin Hussain Al Amiri, assistant undersecretary of the health regulations sector at the Ministry of Health and Prevention, was quoted as saying in the paper.

The ministry also intends to continue its initiative to reduce medicine prices until drug prices in the country become “the lowest in the GCC”, the paper said.

The UAE has put in place generic drug substitution policies since 2018 and currently has more than 6,000 generic medicines that cost about 60 per cent less than their branded counterparts.

Generic drug sales in the UAE stood at Dh2.5 billion in 2020, representing 19 per cent of the total pharmaceutical market.

“The main barrier to the uptake of generic medicines is patients preferring well-known brands. To expand the local pharmaceutical industry, we need the public to understand more about high-quality alternatives,” Dr Ali Hussain, director of the pharmacy department at the Dubai Health Department, said in the paper.

The report suggested six ways to boost the UAE’s pharmaceutical sector’s growth including: driving collaboration among stakeholders, establishing a robust life sciences research and development ecosystem, developing UAE-based biotechnology and life sciences parks, increasing the UAE’s manufacturing capabilities, adopting cutting-edge technology and growing a highly skilled talent pool.

“We are deploying capital to build a pharma hub that further strengthens the UAE’s regional leadership in the industry. As we invest in expanding capabilities, deepening the talent pool and increasing manufacturing drugs locally, we are helping to redefine the regional pharma landscape,” said Fahad Al Qassim, executive director of health care and life sciences at ADQ.

ADQ, formerly known as Abu Dhabi Development Holding Co, manages $110 billion in assets and has investments in a broad portfolio of businesses. Recently, it has ramped up investments in healthcare and life sciences.

“We are deploying capital to build a pharma hub that further strengthens the UAE’s regional leadership in the industry. As we invest in expanding capabilities, deepening the talent pool and increasing manufacturing drugs locally, we are helping to redefine the regional pharma landscape,” said Fahad Al Qassim, executive director for healthcare and life sciences at ADQ.